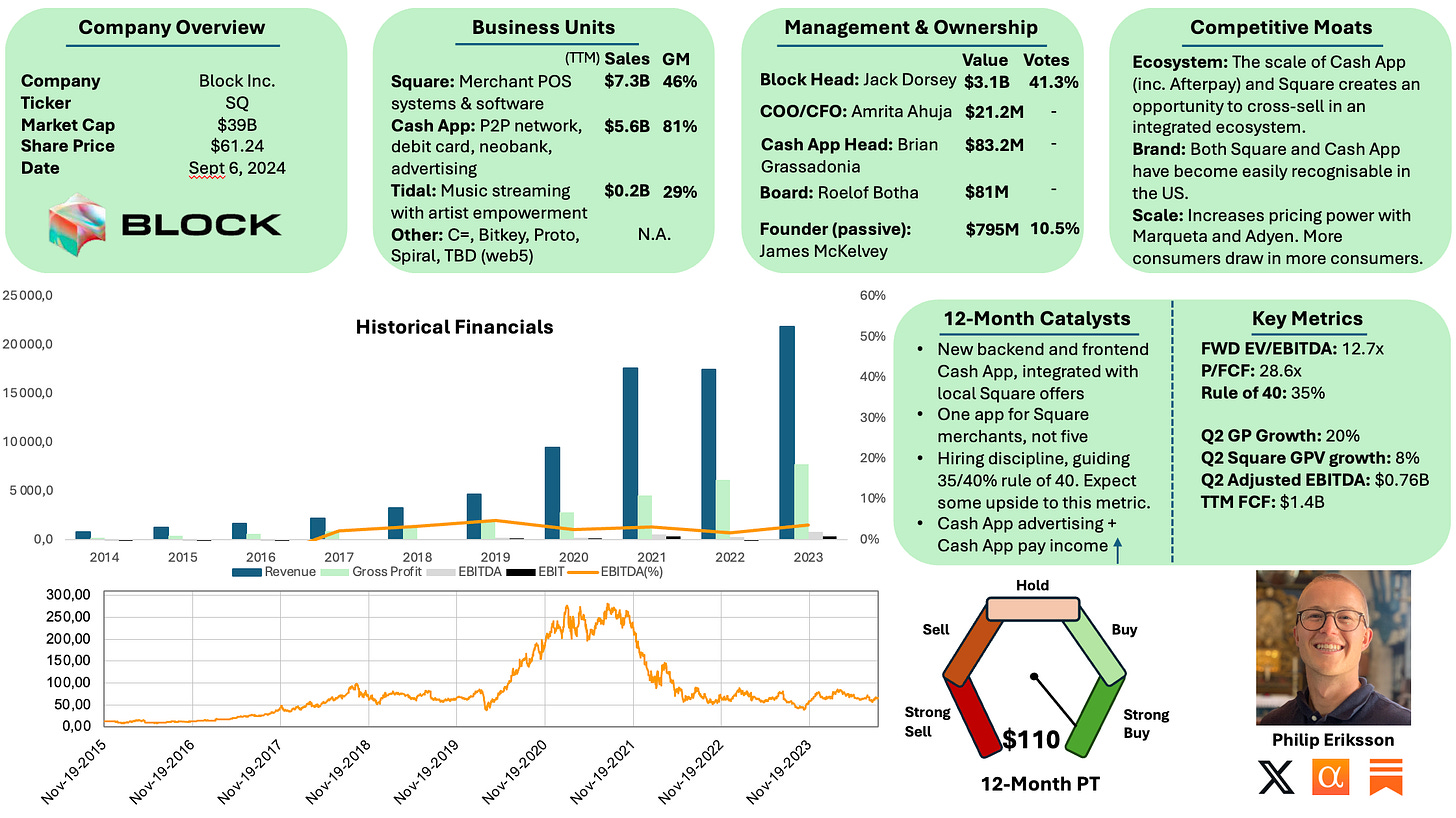

Block Inc One-Pager

From growth to profitable growth, how Block Inc is creating a robust ecosystem

Block Inc. is an undervalued large-cap that has so much room for growth. I argue that the company is significantly undervalued through this one-pager analysis and supporting evidence. This company is a strong buy at the beginning of becoming a robust merchant, consumer, and bitcoin ecosystem.

Subscribe for more One-Pagers!!

Business Units

1. Square

Square remains the foundational unit of Block Inc. and is a leader in the merchant payment processing space. Originally focused on enabling small businesses to accept credit card payments through mobile devices, Square has since evolved into a full-fledged ecosystem for point-of-sale (POS) systems and software solutions for businesses of all sizes.

Key Offerings: Square's ecosystem includes hardware (like the Square Reader), POS software, inventory management, payroll services, and customer engagement tools. These tools help businesses manage everything from sales to employee schedules.

Revenue Contribution: As of 2024 (TTM), Square contributed $7.3 billion in revenue with a 46% gross margin. It remains one of the company's largest revenue streams.

Target Audience: Square's user base ranges from small business owners (such as coffee shops and retailers) to large enterprises that need more complex payment systems.

2. Cash App

Cash App is a peer-to-peer (P2P) payments platform that has become one of Block's most profitable ventures, with a focus on both consumer finance and digital banking.

Key Features: Cash App allows users to send and receive money, make online and in-store payments, invest in stocks and Bitcoin, and even file taxes through its partnership with Credit Karma. Its user-friendly interface and ability to link with bank accounts or debit cards have made it a favorite among younger consumers.

Revenue Contribution: Cash App generated $5.6 billion in revenue with an 81% gross margin. The high margins come from its ability to monetize through features like instant deposit fees, Bitcoin trading, and Cash App Cards (debit cards linked to users' accounts).

Growth Potential: Cash App’s ongoing development into an all-in-one financial service platform could further deepen its integration into the daily lives of users, with new features like advertising and pay income (allowing users to receive paychecks directly into Cash App).

3. Tidal

Block acquired Tidal, a music streaming platform, in 2021 to diversify its business beyond finance and payments. Tidal focuses on offering high-quality audio streaming and artist empowerment, providing a unique value proposition compared to competitors like Spotify and Apple Music.

Key Offerings: Tidal differentiates itself through high-fidelity music streaming, exclusive artist content, and a commitment to paying artists higher royalties. The platform aims to create a more equitable music industry by giving artists a larger stake in their music distribution and sales.

Revenue Contribution: Tidal's revenue is relatively small compared to Square and Cash App, contributing $0.2 billion with a 29% gross margin. However, Tidal is seen as a strategic move to align Block’s ethos of financial empowerment with artistic empowerment.

Future Vision: Block is likely to continue leveraging Tidal as part of a broader strategy to create a creator economy, where artists and musicians are compensated fairly for their work, potentially through decentralized platforms (like TBD).

4. TBD

TBD is Block’s decentralized financial services division, focusing on building a decentralized internet known as Web5. The name comes from the idea that Block is skipping Web3 (which focuses on decentralized finance) and heading toward the next iteration of the web.

Key Objectives: TBD's mission is to build a decentralized network where users own their own data and identity, bypassing centralized platforms. This is in line with the philosophy of Web5, which integrates elements of Web3's blockchain technology and Web2's user-friendly interface.

Projects: TBD is developing tools to help developers create decentralized apps (dApps) and services, giving people control over their financial and digital assets without relying on intermediaries.

Strategic Importance: TBD is crucial for Block’s long-term strategy to become a leader in the decentralized space, particularly in financial services, giving individuals more autonomy over their economic decisions.

5. Proto

Proto is Block’s mining hardware and software developer. This started out as a small project a few years back which has now developed into a fully integrated hardware and software solution for Bitcoin miners. The business unit recently disclosed a deal with North American bitcoin miner Core Scientific, kickstarting the future for more deals.

Key Objectives: Decentralize mining infrastructure and secure a supply chain of Bitcoin mining hardware that is not from China (Bitmain is currently the largest supplier

Projects: 3-nanometer (3nm) mining ASIC, an industry-first (Read more). Software comprises mining management, machine diagnostics & productivity measures, power tuning, and failure notifications.

Strategic Importance: Block has always tried to help sellers close a sale. In this case, they are helping miners get the next Bitcoin in an efficient way. Further down the line, Block could sell the product to consumers which allow them to generate passive income, strengthen the mining ecosystem, and potentially integrate with Cash App and Bitkey to spend and save in Bitcoin.

Competitive Moats

1. Ecosystem:

Block Inc.’s ecosystem is one of its most powerful competitive advantages. The integration of Cash App, Square, Afterpay, and other Block business units (such as Tidal and TBD) creates a unique opportunity for cross-selling and user retention within the same ecosystem.

Cross-Selling & Synergies: Block’s strategy revolves around building an "ecosystem of ecosystems," where different business units reinforce one another. Cash App and Square interact synergistically by serving different but complementary customer bases—Cash App users (individual consumers) and Square users (businesses). Afterpay, the "buy now, pay later" service, acts as a bridge between the two ecosystems, giving businesses on Square the ability to offer payment flexibility to customers, while driving more engagement within Cash App by offering Afterpay services to its users.

Cash App Pay & Square: Jack Dorsey explained how Cash App Pay is emerging as a fast-growing feature that is both a merchant and consumer solution, integrating seamlessly across their ecosystems. Merchants can access Cash App users, and consumers are drawn into the broader Block ecosystem through this payment feature. Additionally, Dorsey mentioned plans to unify Square’s apps and leverage AI technology to enhance user experiences, making the cross-ecosystem interactions smoother and more appealing.

Growth Potential: By offering consumers and businesses a wide array of services that are interconnected, Block can significantly reduce churn. The company is working on tools that enhance onboarding and product engagement, leading to an environment where users rely on Block products for multiple aspects of their financial needs. As Dorsey stated, Cash App aims to become the primary financial tool for customers, a vision made possible by this integrated ecosystem.

2. Brand:

The strength of Block Inc.’s brand, particularly with Square and Cash App, has made these products easily recognizable and trusted by both consumers and businesses, particularly in the US.

Cash App’s Appeal: Cash App has emerged as one of the most recognized peer-to-peer payment platforms in the US, especially among younger consumers like Gen Z and Millennials. According to the transcript, 75% of Cash App’s user base comes from these two demographics, showing strong brand loyalty and growth potential. The peer-to-peer nature of Cash App creates a viral, word-of-mouth growth mechanism, where users bring others onto the platform by sending or requesting money, reinforcing the strength of its brand.

Cash App Pay: Dorsey acknowledged his initial skepticism about Cash App Pay's success but expressed surprise at how well it has performed. He attributed this to brand recognition, saying that despite not necessarily being the fastest payment method, Cash App Pay resonates with users because they trust and value the brand. This demonstrates the strength of Cash App’s brand and how it can drive adoption, even in competitive markets.

Square’s Trust Among Merchants: Square has maintained its position as a trusted, simple-to-use platform for small businesses. It has become synonymous with mobile and in-person payment systems for SMEs. By simplifying its offerings into a single app, as discussed in the transcript, Square is aiming to reinforce its brand as an all-in-one solution for merchants, making it even easier for businesses to adopt their services.

3. Scale:

Block Inc.’s scale gives it significant advantages in pricing power, particularly with key industry partners like Marqeta and Adyen. As Block’s user base grows, especially through Cash App and Square, it creates a network effect that enhances its ability to attract more users and negotiate better deals with suppliers and partners.

Pricing Power & Supplier Leverage: By serving millions of consumers and merchants, Block Inc. can negotiate better terms with payment processing partners like Marqeta and Adyen, both of which are instrumental in enabling Block’s payment infrastructure. More users and transactions on Cash App and Square make these services critical partners for Marqeta and Adyen, thereby giving Block leverage to negotiate better processing fees.

Partnership Strategy: Block is also expanding its partnership strategy by signing deals with major distribution partners like US Foods. Dorsey explained that Block now has access to 40% of the restaurant market in the US, which significantly enhances its reach. This kind of scale not only boosts Cash App’s and Square’s customer acquisition but also solidifies Block’s position in negotiations with suppliers and distributors.

Network Effects: The increasing adoption of Cash App and Square by both consumers and businesses creates a network effect where the more users the platform attracts, the more valuable the ecosystem becomes. Cash App Pay was highlighted as a key growth driver, expanding into large merchants like Google Play, which demonstrates how Block’s scale can attract top-tier clients and further enhance its competitive position.

12-Month Catalysts: Road to $110

1. New Backend and Frontend for Cash App, Integrated with Local Square Offers

Block Inc. is focused on enhancing Cash App's infrastructure to deliver a better user experience and integrate more deeply with its Square ecosystem.

Integration with Square Offers: One of the most significant upgrades mentioned is the integration of Cash App with local Square offers, creating a seamless experience for users who interact with Square merchants. This integration not only deepens the relationship between Square sellers and Cash App users but also facilitates cross-selling. Cash App’s new backend and frontend provide users with local offers, encouraging them to spend more within the Block ecosystem.

Beefing up the Ecosystem: Jack Dorsey noted that Cash App is working on rounding out features that support its "bank the base" strategy, increasing marketing around these features. Integrating local Square offers into Cash App will provide a stronger value proposition for consumers, making them more likely to engage with Square merchants and deepen their loyalty within Block’s ecosystem. He highlighted that products like Cash App Pay and Cash App advertising will play a pivotal role in creating synergies between the business units.

2. One App for Square Merchants, Not Five

In the past, Square offered multiple apps to merchants, which made onboarding and navigation cumbersome. Block Inc. is consolidating its offerings into one streamlined app for Square merchants.

Simplified Experience: Block’s decision to move from five separate apps to a single app for Square merchants is aimed at simplifying the onboarding process and reducing friction for merchants. This new app will adapt to the specific needs of each merchant, offering customization based on the business type and the individual’s role in the company. This simplification is expected to boost adoption rates and improve the merchant experience.

Product Onboarding: Jack Dorsey mentioned that it used to take over 20 minutes and up to 30 steps for a merchant to sign up for Square. By reducing this to just four steps with a single app, the company is aiming to increase its acquisition of new sellers and make it easier for existing merchants to access Square’s full range of products. Dorsey emphasized the importance of moving fast and improving product onboarding, which will further help Square compete with its peers by providing a more intuitive and streamlined experience for merchants.

3. Hiring Discipline, Guiding 35/40% Rule of 40. Expect Some Upside to This Metric

Block Inc. is maintaining hiring discipline and focusing on achieving strong operating income margins while growing gross profit. This approach aligns with their target of achieving the Rule of 40, a key financial metric for growth-stage companies (gross profit growth + operating income margin).

Financial Discipline and Efficiency: Block is focusing on balancing growth with profitability. The Rule of 40 metric guides companies to focus on both growth and margin improvement, and Block is projecting to reach 35/40% under this rule in 2024, with expectations of hitting Rule of 40 by 2026.

Commentary from Amrita: Amrita Ahuja mentioned that Block delivered a 20% year-over-year gross profit growth, and their focus on efficiency and expense discipline has significantly improved their adjusted operating income. Adjusted EBITDA nearly doubled year-over-year, and adjusted free cash flow for the 12 months ending June was $1.43 billion, up significantly. The company is also raising its full-year 2024 guidance, showing confidence that its Rule of 40 target is achievable. Block's shift to a functional organizational structure is expected to contribute to faster and more efficient execution of growth strategies.

4. Cash App Advertising + Cash App Pay Income

Cash App is increasingly becoming a platform for advertising and a powerful revenue driver through Cash App Pay, both of which have been showing strong growth.

Cash App Advertising: As part of its strategy to monetize its growing user base, Cash App has started to incorporate advertising features. These ads are tailored to users' financial behaviors and spending patterns, providing a new revenue stream while enhancing the platform’s ecosystem. This revenue from advertising is expected to grow as more merchants use Cash App Pay and benefit from Block’s ability to deliver targeted ads to a highly engaged user base.

Early Stages for Advertising: Amrita Ahuja highlighted that Cash App Card, Cash App Borrow, and buy now, pay later products showed strength in Q2 2024. Jack Dorsey also discussed how Cash App’s advertising model is still in the early stages but is expected to increase as the company invests more in marketing in the second half of 2024. The integration of Cash App advertising with Cash App Pay gives merchants a way to reach a broad and engaged audience, which will drive further adoption of the payment system.

Cash App Pay Income: Cash App Pay has grown significantly, with transaction volumes up 7X year-over-year. This payment feature allows merchants to tap into Cash App’s user base, providing them with a low-cost payment solution. Cash App Pay has rapidly gained traction, with large merchants like Google Play already onboard, and more merchants are expected to follow as Block continues to market the product and expand its reach.

Synergies between Afterpay and Cash App Pay: Dorsey acknowledged that Cash App Pay surprised the company with its strong growth, noting that more than 80% of Afterpay US users are now active on Cash App Pay. He highlighted that large merchants value Cash App Pay because it grants access to Cash App’s highly engaged user base, offering competitive pricing for merchants and driving more volume through the platform.